An installment is a sale of an asset in which any payment is received in a year following the year of sale. Real estate is often sold this way and it has its advantages.

In today's market, sometimes it is very hard to navigate the requirements the banks impose on borrowers. It is time consuming, invasive and expensive, so many buyers today would just rather not.

A seller with no mortgage on his property has an advantage of considering to take back financing on his home. He would do this for several reasons, but the basic reason is MORE MONEY.

A Caveat

The major problem of course is loan default. Should the buyer not pay, the seller may be forced to foreclose and take his property back. (it happened to me - it wasn't that bad) This can be expensive, so I always recommend that the seller get a pretty good down payment so the buyer will not be encouraged to run away. If he has no skin in the game, he may just quit. If he has money on the table, he is less likely to walk away from it.

Buyers will pay more

Adding seller financing to a home is like adding a new porch or roof. It increases the value of the property. Buyers will pay more because they know they won't have that microscope shoved up their financial assets and the costs associated with that procedure.

Seller usually receives a higher interest rate

A seller can demand a higher interest rate from the buyer simply because the buyer doesn't have to go to the expense and aggravation of going to the bank. Buyers are very willing to pay higher interest for this advantage.

Lower Taxes

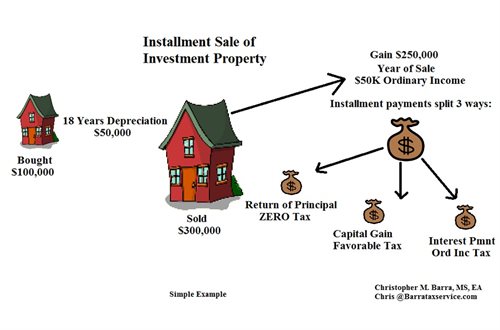

Because of the tax treatment of installment sales, the seller gets to keep more of that higher price and better interest rate. He pays tax only on what he receives and not even all of that as some of it is return of his original investment, and not taxed at all. However we must point out that the seller has to recognize (claim as income) the accumulated depreciation on the property in the year of the sale - so make sure you get enough of a down payment to cover those taxes attributable to that.

When a seller receives a payment it is divided into three parts:

Interest on the loan - Fully taxed as ordinary income

Gain on the sale - Each payment is divided into interest and principal, part of the principal is the gain on the sale taxed at capital gain rates.

Return of Principal -This is the amount of each payment that is a return of his original investment - so not taxed varies in each case.

A substantial portion of the payment is not taxed or taxed at a low rate.

Unlimited Creativity

When writing your own loan (with or without the help of a pro) you can pretty much do what you want. You can increase payments over time, request lump sums from time to time, amortize over 30 years with balloon payment after 10 years, even have a variable rate to protect yourself. It is very flexible, you are limited by your imagination.