We have seen our shareof the economic pie reduced from 93% in 1900 to what many now estimate at less than 50% with the government (federal and states) absorbing all the rest through their various methods of taxing, registering, fining and penalizing. The policies of taxation and money manipulation are in place to feed the giant government beast. The more it grows, the more it needs just to survive.

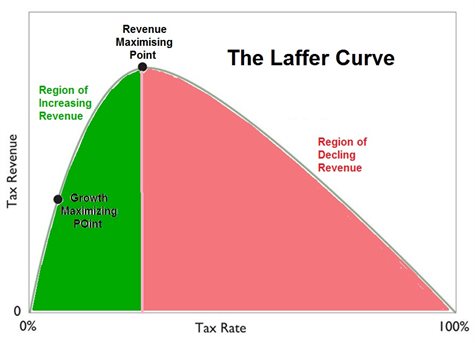

Arthur Laffer developed a mathematical tax formula in the 1970’s (Laffer Curve) in which he attempted to pinpoint the best tax rate government should impose to be able to collect the most revenue. The best rate is not the highest rate. Too high a rate and people would be less productive and revenue collection would diminish. Too low a rate and the government would be missing out on some cash it could have easily appropriated for its use. See Graph.

This theoretical tax formula is largely based on human nature. There is a tax rate at which ordinary people will stop producing because they believe their share of earnings is not enough to justify their continued effort. They don’t want to pay the tax, so they don’t produce. They slow down and intentionally earn less. If tax rates are too low, economic activity may be more brisk as people work longer, harder and more efficiently. That it is said, is bad for government as it leaves too much money on the table. Somewhere in the middle lies the optimum tax rate for maximum collection potential.

Our rulers constantly argue about this optimum tax rate at particular points in time. They want to ascertain this precise position to maximize

Column 2

governmental receipts from all various forms of taxation so that theoretically at least, they can have the most money to do the most good.

Hold on a minute.

Can you imagine what may have happened if when our founders were writing our Constitution, Benjamin Franklin stood up and said: “Gentlemen, we must determine the maximum taxation point the people will accept before rebellion, and continually strive to tax at that rate. Clearly any lower and government will give up growth opportunities.”

They would have hosed him down, and sent him out in that storm not with a kite and a key, but a 20 foot copper lightening rod strapped to his brain.

Is the objective of government to grow itself as fast as possible so it can become as large as possible? No. The goal is to have the least government and run it as efficiently as we can so that the citizenry can live freely and safely. This is not to suggest that Mr. Laffer believed it was the best way to tax. He only said it was the best way to target raising of the most money, assuming that was the objective.

This begs the question: Why then should we even discuss the optimum tax rates to grow a government? We should never even think of it. The goal should not be to bring in as much money as humanly possible to grow the government as large as it can be. It should be to treat the citizens as fairly as possible and have as little government intervention to that end. The goal is to have limited government. It was when we were founded and it still should be.

The Laffer Curve maximum return point is only a relevant argument for promoting a socialist society. To obtain the largest government affordable was absolutely not our founder’s intention and also contrary to the objective of every working person who is financially forced to support it. Again, it doesn’t matter what our founders thought, only if they were right or wrong. Here again they were right once more: The goal clearly cannot be to grow government as large as possible; that is contrary to individualism and freedom.

The purpose of government is to serve the people, not vice-versa. Currently the purpose of taxation and other types of government revenue raising clearly is to remove as much money out of the private sector as is humanly achievable. If we use the Laffer Curve as an argument for either raising or lowering tax, government is the problem. By using this argument, it’s obvious purpose is to no longer be the people’s advocate, but to create the largest governmental beast achievable to serve itself.

Milton Friedman

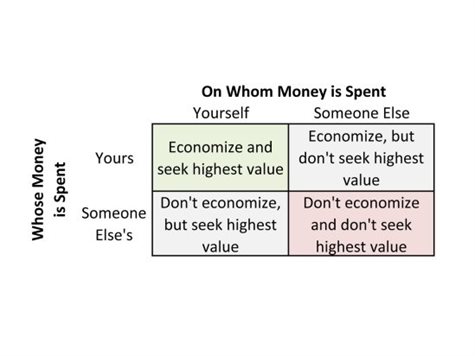

Milton Friedman was a brilliant economist. He simplified what he considered the reason that government is so wasteful in a way most of us can comprehend. He had a way of explaining economics so even a public school teacher could understand it. He made the analogy that if you spend money on yourself, you look for both economy and value. This is human nature. We look to save our own money, but at the same time get good value for ourselves in whatever we buy.

He explained the economics of governemnt with what has become to be know as the Friedman Box”.

Friedman suggests that the last box, lower right, is how government operates and is the reason why it is so imperative that they do as little as possible.

When you spend your own money on yourself, you will economize and also seek the highest value.

When you spend your own money on someone else, you will economize, but won't seek highest value.

When spending someone else's money on yourself, you won't economize, but you will seek the highest value.

When we spend someone else's money on someone else (what government always does) we won't economize and also won't seek highest value.

When we spend money on someone else, we naturally want to economize, but we are just not as careful about getting good value. This makes sense because we spend our money, we want to spend less, and because we are spending it on another person, we are not as careful that we receive good value in return. Again, we are only imperfect human beings so we don’t care as much about the value of another as our own, but since it is our money, we still want to economize.

When we spend someone else’s money on ourselves we still want good value, but we care much less about what it costs because we are not paying for it. We still want something good, but price really doesn’t matter much when someone else is footing the bill.

When someone else spends money contributed from yet another person, forget it. In this situation, since the one spending it is not the recipient, or even the provider, we tend to seek neither economy nor value.

Friedman suggests that government operates in this manner, and it is hard to argue that point. They take money from some and filter it through to others. It spends other people’s money on other people.

Since there is no inherent reason to be economical, in order to maximize efficiency in government it must therefore be required to spend as little as possible. It must be small, limit its range and spend very little money.

There shouldn’t be a need to redefine the role of government itself, but to enforce our already clearly written constitutional limitations upon it. We must return its scope to only those critical activities our founders envisioned. We have to regress. The purpose must be to operate as limited a government as workable while taking as little as possible from the people. Where is that chart?

Let’s call that the Barra Chart. This is an inverse relationship, a much simpler graph. As tax rates climb higher, the less liberty citizens enjoy, the more wasteful government becomes, so naturally we want to maintain taxes as low as we can and still function so that other people spend as little of someone else’s money as possible.

Government does not operate for the benefit of the people, it operates for the benefit of itself. This must change. Naturally we need to have some level of taxation, but if we want an efficient government it must be small.

Like the 1950’s sci-fi movie “The Blob”, our government now attempts to absorb everything in its path and make it part of itself. We must put in place a government-shrinking plan. I don’t think we can spray it with giant anti-government extinguishers, freeze it and dump it in a remote area of the universe. But - yes we can begin to limit the size and scope of our own government, and we suggest the remedy. It will take some time.

It took 100 years to transform largely independent, responsible, strong-willed, freedom-loving Americans into government relying “please sir, may I have another” socialist bunch of self-pitying whiners. Because of it, we are now nearly bankrupt.

We want to help transform this destructive thought process by suggesting reasonable arguments – you know, the simple ones, the honest ones; those we used to live by without question. If we don’t change the way we think, we may not recover as a nation. Again with a reference to a classic movie, consider the advice the prison guard gave Paul Newman’s character in the movie “Cool Hand Luke”:

"You've got to get your mind right".

(From the book "Enlighteded Regressivism", by

Christopher M. Barra