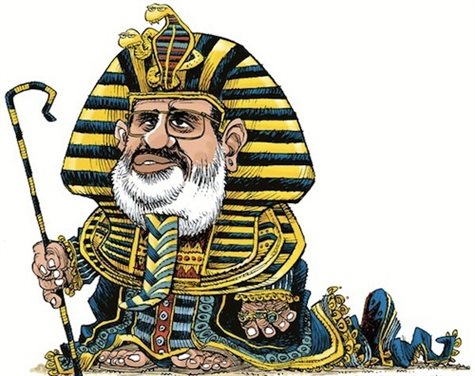

THINK LIKE A PHARAOH – NOT A SLAVE

Think like a Pharoah

The pyramids took a while to build, several generations in fact, each one more than a decade or two. The pharaoh Khufo, who began the great pyramids of Giza, knew they would likely have to be finished by his heir’s, some of whom were yet to be born. He knew he may never see the completed fruits of his labor, well, his laborer’s labor, some claim slave labor - but he was the manager. Although he realized that the giant pyramids he was building may not be completed during his lifetime, after they were finished, they would live on for many generations to come.

Real estate should be perceived this way too. Think like a pharaoh. You begin the process by initially struggling a bit maybe to buy it, then you pay off the debt, and collect income for the rest of your life. After the mortgage is paid off, you will still have taxes and insurance to deal with and every year (if you choose to carry insurance – I recommend it but it is optional) but by and large it now becomes a cash cow. It provides income for a very long time, could be for generations - if your heirs are smart enough to maintain it. The maintenance of a well kept property is a lot cheaper than building a new one.

Continue to build

After the first pyramid is established, you will start to build more. Buy additional real estate and do the same thing. Hopefully you won’t wait until the first pyramid is fully completed, but will start on others while building the first. How many could you do if you started one every three or four years?

After you take the eternal dirt nap, your heirs will now have property for the rest of their lives. Hopefully, with some of the profits from the rental income they will buy more houses for their heirs, etcetera, etcetera, and live their lives like the true successors of a pharaoh should.

Rents should increase gradually, making this a far better source of retirement income than a mutual fund that depletes over time. Sure, mutual funds don’t need new roofs, and you never have to evict a bad tenant from a growth fund, but the rental income as a percentage of fair market value should be significantly higher than the passive investments and a new roof or heating and air system now and then is just a cost of management.

Simple, basic process

Here is the scenario. The real estate buyer maintains good credit and saves enough to buy his first rental house. He accelerates payments, so he doesn’t clear much cash flow the first ten years, sometimes even longer, but eventually the mortgage is retired. Like the poor laborers doing most of the work building pyramids for their beloved pharaoh, someone else also does most of the actual heavy lifting (paying for your house) – tenants. When the tenants finally pay off your mortgage, the money begins to flow from the cash cow you nurtured for over a decade (or maybe even two) from a little needy, milk-less real estate calf.

Unlike some pensions, the rental income should never stop. It should also gradually increase over time as inflation causes rising prices, which includes increasing rents. This allows the owner to better maintain retirement lifestyle. Don't forget - even those coveted golden parachute government pensions won't carry through to children and grandchildren. Real estate will, so long as your heirs have been taught to continue in your footsteps. Heirs of pharoahs often become pharoahs themselves.

Think like a pharaoh, not a slave - and you (and your heirs) can live like royalty.